Lower Rates, More Choices Create New Opportunities

Mortgage interest rates continue to trend down this spring. Coupled with stable prices and increased inventory in many neighborhoods, a “perfect storm” may be brewing for buyers during the hot summer home-buying season.

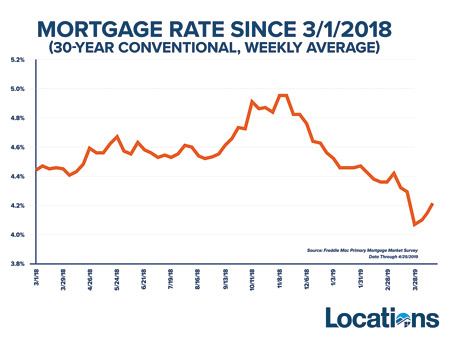

In late 2018, mortgage interest rates reached nearly 5 percent, giving would-be homebuyers pause. However, rates have been trending down since then, with the biggest rate drop in a single week in more than a decade occurring in March.

Although rates have ticked up a bit this month, today’s rates are still lower than they were a year ago. The weekly average for a 30-year fixed loan is 4.17 percent this week, compared to 4.6 percent in April 2018. Even better, it appears that rates of around 4 percent are here to stay, at least for a while.

“A year ago, we were talking about low inventory and rising interest rates — it was hard for many to find a home,” said vice president of sales for Locations Chad Takesue. “Today, there’s actually more inventory on the market, and interest rates are lower. Market conditions are much more favorable now for homebuyers than they were last year.”

Takesue adds that while lower interest rates are often associated with first-time homebuyers, lower rates are beneficial to move-up buyers, too. Move-up buyers who are able to take advantage of the proceeds from the sale of their current home and lower interest rates can lower their monthly payments and move to a home or neighborhood that better suits their needs or lifestyle.

Stable prices, more choices

While islandwide median single-family home prices have continued to gradually increase over the past year, they are rising at a modest rate of 4 percent. In some neighborhoods, prices have increased by less than 4 percent. Oahu condo prices, on the other hand, are level, although some neighborhoods have seen price increases and a few have seen price decreases.

Housing inventory has been steadily rising, too, with more single-family homes and condos for sale than the previous year in nearly all Oahu neighborhoods. With more housing options to choose from, across a wide range of price points, homebuyers are also afforded more time and less competition.

Opportunities for sellers, investors

Lower rates are, of course, good news for homebuyers, as lower rates mean lower monthly mortgage payments. But lower mortgage rates are also good news for current home sellers, especially those who may have had slower-than-expected interest from buyers. Since lower rates allow would-be homeowners to stretch their dollar a bit more, the buyer pool instantly widens when rates move down. Current sellers may want to consider a price improvement to entice new buyers this spring — depending on competition in their neighborhood or building.

Real estate investors benefit from lower rates, too, as lower rates create more opportunities for investors to use 1031 exchanges to upgrade their investment portfolios.

Even current homeowners who have a higher rate can benefit from refinancing their loan — the money saved could be applied to home renovations or put toward an investment property.

“This spring is a great time for homebuyers to get back out there — while rates are still historically low and there are more available properties than there have been in recent years,” Takesue adds, noting that if you don’t have a REALTOR®, you can find one at LocationsHawaii.com.

See More Listings