Be Prepared Hurricane Season Stars Next Week

By Lisa Scontras

While meteorologists are expecting the eastern and central Pacific will have a more normal to tranquil 2020 hurricane season as the current El Niño weakens, it’s not a reason for Hawaii residents to let their guard down — it takes the wallop of only a single major storm to cause significant property damage. Last year, Hurricane Erick, intensified to a major Category 4, before weakening and passing far south of Hawaii Island in August. Erick and Flossie led to high surf along east and south facing shores in August, with heavy, damaging rain over Hawaii County and then across Kauai County.

And while it’s true you can’t do anything about the weather, it is worth the peace of mind to do what you can to be prepared in the event of a weather emergency.

While the official hurricane season runs from June 1 to Nov. 30, the first Pacific tropical depression already formed last month — so it’s not too soon to review your homeowners insurance policy. Beware: Standard home insurance policies are not all-inclusive, and most specifically do not cover damage by hurricanes or flooding. Don’t learn this the hard way — there are additional home insurance coverages specifically designed to cover hurricane and flood losses — and you need them both to be adequately covered. Bear in mind, once a named storm is approaching the islands, it may be too late to obtain these coverages.

Hurricane insurance is generally a rider (in Hawaii), which is added to your existing policy at an additional cost. Hurricane insurance does not cover damage from storm surge during a hurricane. For that, you need flood insurance. Hurricane insurance protects your property from damage caused by wind and wind-driven rain — not rising surface water.

Flood insurance policies are sold separately, and cover damage from rising surface water, however it was caused. The water may come from heavy rain, an overflowing river, stream or canal, from a tsunami, or from storm surge during a hurricane. Flood insurance is regulated through the Federal Emergency Management Agency and has a mandatory 30-day waiting period before it goes into effect.

And if you live in a condo, typically the homeowners association provides hurricane insurance for the structure, but insuring the contents against hurricane damage is still up to each individual homeowner.

Many homeowners wrongly assume that if they’re not in a designated flood zone, they don’t need flood insurance. Truth is, according to FEMA, almost 25 percent of flood insurance claims are paid to victims living outside an established flood zone or in zones labeled low- to-moderate flood risk.

In case of a disaster, the last thing a homeowner should be worrying about is whether or not they have adequate insurance coverage.

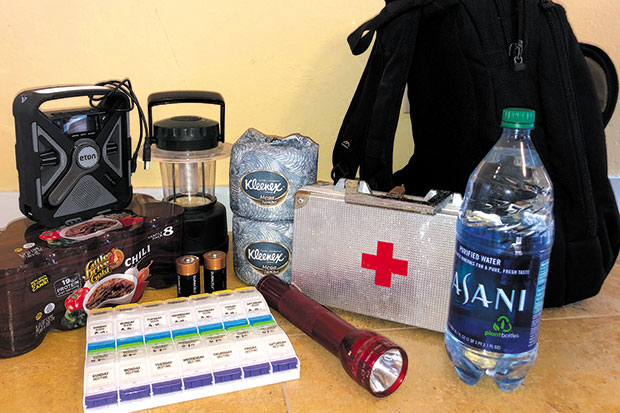

Take the time to evaluate your coverages, create a disaster plan and kit, and better protect your home and family.

See More Listings