The Sweet Spot BETWEEN PRICE AND MORTGAGE RATES

By Lisa Scontras

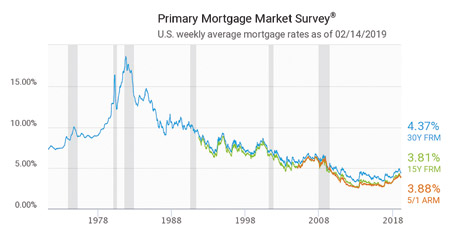

Graph courtesy Freddie Mac

It’s the million-dollar question: Should I hang on and wait for prices to come down, or buy now while mortgage rates are low?

As it turns out, waiting for that lower price can cost you more.

If you’re like the majority of homebuyers, you’ll rely on a mortgage/loan to finance your purchase. The prevailing mortgage interest rate — the “cost” of borrowing money — will play a big part in not only determining your purchase price, but also your monthly payment.

According to Freddie Mac, for the past 50 years, 30-year fixed-rate mortgage rates first dropped below 5 percent in April 2009. In October 2011, the average rates fell below 4 percent. But rates started rising in 2018, and the U.S. weekly average for a 30-year mortgage reached 4.94 percent for two consecutive weeks in mid-November — the highest in seven years. The U.S. weekly average 30-year-fixed rate mortgage as of Feb. 14 was 4.37 percent, down slightly.

“The housing market is obviously very sensitive to mortgage rates,” said Lawrence Yun, chief economist at the National Association of Realtors. “Now with mortgage rates lower, some revival in home sales is expected going into spring.”

Just how big of a deal is this? For the purpose of comparison, we did the math to figure out monthly payments on a $750,000-purchase price with 20 percent down, using a 30-year, fixed-rate mortgage. We crunched monthly payments using different mortgage rates at mortgagecalculator.org.

At a mortgage interest rate of 3 percent, a $750,000 home with 20 percent down, would be an estimated monthly cost of $2,530 — that’s principal and interest, excluding any taxes, insurance and maintenance fees.

At 4 percent, the same monthly loan payment estimate is $2,864 — again, principal and interest only.

If rates go up to 5 percent, the monthly payment on that same home goes up to $3,221.

Furthermore, once rates reach 6 percent, the estimated monthly cost on that loan is $3,597.

Let’s say our sample home’s price tag drops to $700,000. The resulting monthly payment at 5 percent would be roughly $3,006, and at 6 percent, $3,357.

Now these are simply estimated costs for comparison purposes. To get actual monthly payments, talk to a loan officer who can figure your actual costs based on your financial profile. But the point is, waiting can be expensive.

From 1978 to 1986, rates were higher than 10 percent. In September 1981, rates hit a whopping 18 percent for three months. The payments on our $750,000 sample home at 18 percent would be more than $9,000 a month.

If you’re considering buying a home and you plan to get a loan, now is a great time. There’s no telling when rates will again rise to 5 percent or higher, but you can be pretty sure that once they do, they likely won’t come down this low again for a long, long time.

See More Listings